Introduction

Forex trading is a complex and dynamic market, and one of the common occurrences that traders often face is slippage. However, the concept of slippage is often misunderstood. This article aims to provide a comprehensive understanding of what slippage is, how it occurs, and how traders can minimize its negative effects while potentially maximizing its positive impact.

What is Slippage?

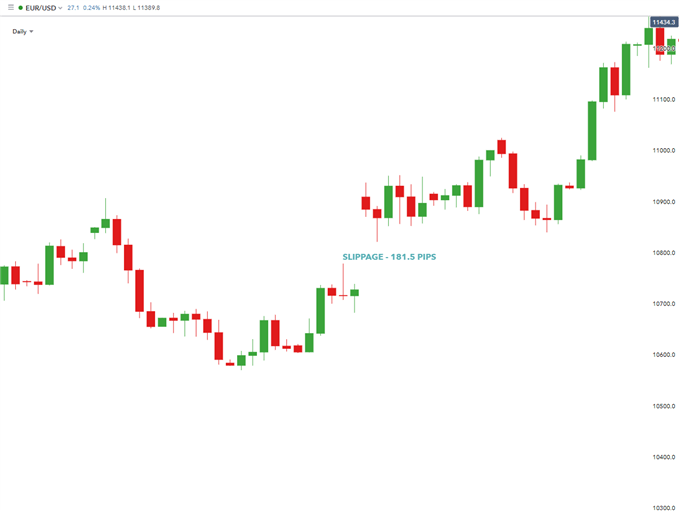

Slippage in forex trading refers to the situation when a trade order is filled at a price that is different from the requested price. This typically happens during periods of high market volatility or when the desired prices cannot be matched with available orders.

When traders send out their forex trading orders to be executed by a liquidity provider or bank, those orders are filled at the best possible price, regardless of whether it is above or below the requested price. This means that slippage can result in three potential outcomes: no slippage, positive slippage, or negative slippage.

No Slippage

- In this scenario, the trade order is submitted, and the best available price matches the requested price exactly. The order is then filled at that precise price.

Positive Slippage

- If the best available price suddenly becomes more favorable than the requested price, the order is filled at this better price. For example, if a trader attempts to buy the EUR/USD at 1.3650, but the best available price changes to 1.3640, the order will be filled at this improved price.

Negative Slippage

- Conversely, if the best available price suddenly becomes less favorable than the requested price, the order is filled at this higher price. For instance, if the best available buy price changes to 1.3660, which is 10 pips above the requested price of 1.3650, the order will be filled at the new price of 1.3660.

Therefore, slippage occurs whenever a trade is executed at a different price than the one initially requested.

Causes of Slippage and How to Avoid It

Understanding the causes of slippage is crucial for traders seeking to mitigate its effects. Slippage occurs due to the fundamental structure of the market, which relies on the presence of both buyers and sellers at specific prices and trade sizes. Any imbalance between buyers and sellers causes price movements in either direction.

When a trader wants to buy a certain currency pair at a specific price, such as 100k EUR/USD at 1.3650, the order can only be filled if there are sellers willing to sell their Euros for 1.3650 USD. If there is a scarcity of sellers at that price, the order will be executed at the next best available price, resulting in negative slippage.

On the other hand, if there is an excess of sellers willing to sell their Euros at a lower price than initially requested, the trader may experience positive slippage, buying the Euros at a better rate than expected.

It is important to note that slippage can also occur in relation to stop-loss orders. In some cases, normal stop-loss levels cannot be honored, leading to slippage. However, there are special types of stop-loss orders known as guaranteed stop losses, which are honored by the broker regardless of market circumstances. Guaranteed stop losses provide traders with peace of mind, knowing that their positions will be closed at their specified levels, but they may come with a premium charge if triggered.

Least Prone Currency Pairs and News Events

Under normal market conditions, more liquid currency pairs tend to experience less slippage. Examples of such pairs include EUR/USD and USD/JPY. These pairs usually have a higher trading volume, offering greater liquidity and reducing the likelihood of slippage.

However, during volatile periods, including important data releases or news events, even the most liquid currency pairs can become prone to slippage. Volatility significantly increases during these times, making it more challenging to execute orders at precise prices.

To prepare for volatile market conditions, traders should seek strategies tailored to such scenarios. It can be helpful to read tips on trading the most volatile currency pairs or download comprehensive forex trading guides to enhance knowledge and understanding of these market conditions.

Conclusion

Forex slippage is a common occurrence in trading, happening when orders are filled at prices different from the requested levels. It is essential for traders to have a thorough understanding of slippage, its causes, and how to mitigate its negative impact. While slippage can be viewed negatively, it can also lead to positive outcomes. By recognizing the factors contributing to slippage and adopting appropriate strategies, traders can navigate this aspect of forex trading more effectively and improve their overall trading performance.

Remember, slippage is an inherent part of the forex market, and traders must develop the necessary skills and knowledge to adapt to its presence.